2022 is off to a rough start for those looking to purchase a new house in the Snoqualmie Valley.

New data released by Northwest Multiple Listing Service (NWMLS) last week compared the housing market in Jan. 2022 to Jan. 2021. The report found that housing availability across King County was down compared to last year, while housing prices continue to fluctuate around 5-year highs.

“It’s nutso right now,” said Karin Simpson, owner of the downtown North Bend-based Simpson Realty Group. “I have buyers sitting on the sideline who are waiting and waiting — then they see a house and there’s 20 offers on it.”

The number of King County active listings in January 2022 is down nearly 60% compared to last year, according to NWMLS. Meanwhile, median county sale prices have risen about 12%, reaching $720,000.

The Eastside is in a slightly greater pinch for active listings, with a 65% drop between Jan. 2022 and Jan. 2021. Median sale prices on the Eastside have ballooned about 35% since last year, reached $1.23 million.

Although King County had the steepest drop in active listings, drops were also seen in across Western Washington, including in Snohomish and Jefferson counties. Prices statewide were up 15% in January compared to last year, at a median sale price of $555,000.

Simpson said the situation in the Valley and its rising housing costs is a basic supply and demand situation — there aren’t enough houses, or residents selling houses, for those who want to live here. Brian Davis, who owns Snoqualmie Valley Real Estate, agreed.

“The Valley has built-in scarcity already, so we don’t have as much ever on the market as say Bellevue or Kirkland,” he said. “There’s an increased demand for sure and there’s plenty of homes getting double digit offers.”

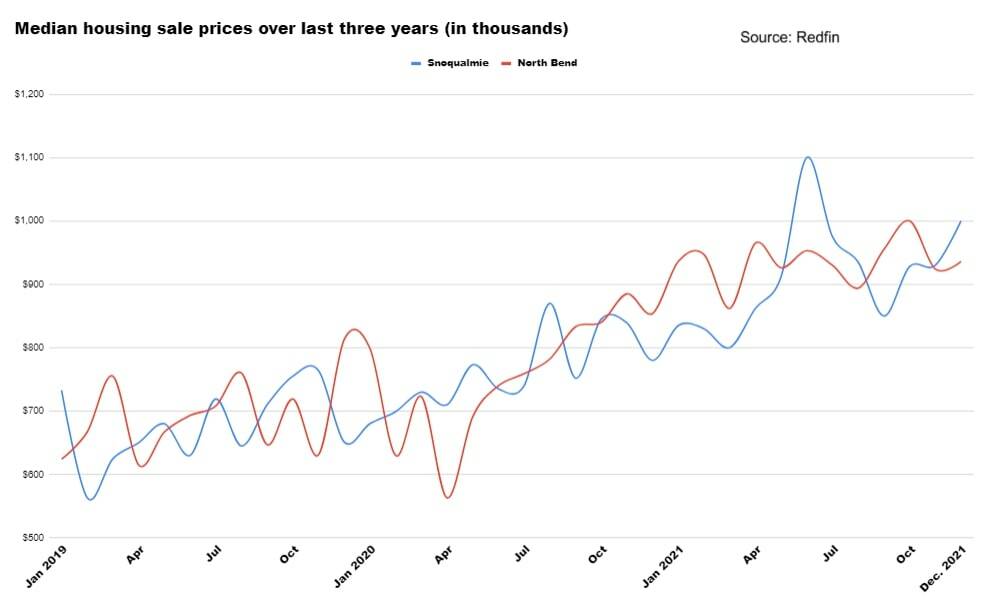

In Snoqualmie, housing prices in December 2021 were up about 20% compared to last year, at a median sale price of $1 million, according to the website Redfin. Current median housing prices are just below the five-year high of $1.1 million set in May 2021.

North Bend is following a similar trajectory, seeing median housing prices in December 2021 rise roughly 13% from last year, for a median sale price of $936,000. That sale price is also near the city’s five-year high of $1 million set in Oct. 2021.

In both cities, houses on the market are regularly getting 15 to 20 offers, Simpson said. Redfin estimates that Snoqualmie and North Bend houses in December 2021 were selling on average 9% and 12% higher than listing price, respectively.

In a press release, NWMLS said the slow January could be attributed to a number of factors such as a surge in COVID-19 cases due to the omicron variant, poor weather and depleted inventory. Simpson said another contributor could be buyers who are trying to take advantage of historically low interest rates. The beginning of the year is also typically a slow point for housing sales.

“The intensity at the beginning of the year is always heightened,” Davis said.

Davis said most new home buyers are coming from outside the Valley, like Issaquah and Seattle, rather than moving within the Valley. He said this has likely been caused by changes in how people work and an increased attraction in outdoor recreation. Davis added that the Valley has also seen a decrease in the number of foreign buyers, who purchase property as an investment.

However, these new homebuyers are going after homes at a greater intensity than in previous years, Davis said, with first-time homebuyers frequently going after homes at higher price points than before.

“I think the big takeaway for me is what these first-time buyers are going after price-wise,” he said. “Some come with their own funds, some from family funds, some with low down payments, some with high, but they’re all going after high prices.”

The good news for homebuyers? NWMLS is predicting the intensity to decrease in the spring and summer when more inventory opens up.

“Know there will be more houses come spring,” Simpson said. “I would recommend to be ready and make sure you have your finances lined up.”