The life science industry has deep roots in Washington, with a melting pot of academic and nonprofit research institutions, local startups, government labs and investment and even global corporations.

From the Fred Hutchinson Cancer Research Center, to the University of Washington, to the hundreds of smaller organization across the state, there are more than 90,000 jobs involved in research and innovation in biotechnology, distribution, digital health, medical equipment, pharmaceuticals and industrial bioscience as of 2017.

There was a 13 percent increase in life science jobs from 2014-17, the biggest upswing in a decade, and industry leaders emphasized these jobs are available on many levels of education.

“There are opportunities for students who have graduated from high school to begin working immediately in entry-level tech positions,” said Leslie Alexandre, CEO of Life Science Washington (LSW). “And those jobs are really well-paying jobs for someone who only has a high school degree and maybe a one-year certificate.

Overall, Washington hosts 1,144 life sciences organizations across 110 cities, according to a LSW report from Jan. 29. LSW, a nonprofit industry trade association, supports the life science industry by assisting in sustaining the workforce, educating entrepreneurs and startups, investing in research and advocating for favorable public policies.

These organizations have the strongest concentration in the greater Seattle area, with dozens throughout the Eastside. Companies from Bothell down to Bellevue and across to Snoqualmie have created hundreds of jobs and are growing.

“After several years of lackluster growth for the life science industry in Washington, we’re excited to have cultivated such strong progress across the state,” Alexandre said. “Building a life science company takes years, but we are now seeing many of our young, research-oriented companies thriving and expanding by adding manufacturing and commercial operations.”

The LSW report attributes this employment growth to companies hiring more workers after years of research and a new wave of up and coming start-ups. These companies are currently scaling up product development and adding early stage manufacturing.

“Those companies started small awhile ago,” Alexandre added. “What you’re seeing [now] is that maturation of those companies…It takes 10 years, especially on the biotech side, before you get something out of clinical trials and approved to market.”

On the upswing

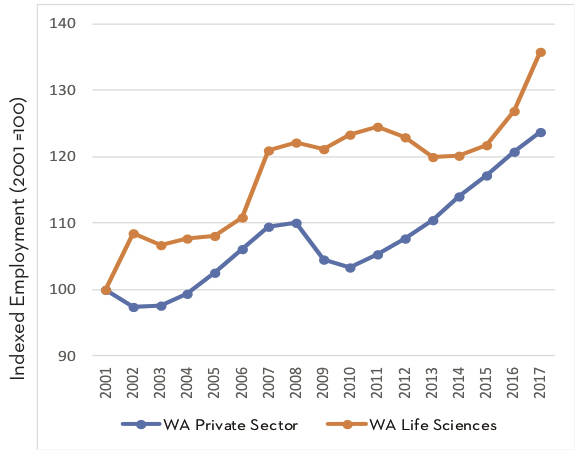

LSW reports that life science job growth has outpaced the private sector in Washington since the turn of the century. With a starting point in 2001, life science index employment has grown by about 36 percent as of 2017, compared to the private sector growth of about 24 percent.

Alexandre credits the industry’s success to “tremendous” education opportunities and research institutions in the area, investment from the state and a prominent “pioneering spirit” in the Pacific Northwest.

“It takes the guts to really go out and say, ‘We’re going to fix this. We’re going to bring the best engineers and tackle the problem,’” Alexandre said. “When you look who’s on the West Coast you have people who immigrated here for a better life and people who crossed the Rockies. When you have someone who has lived through the elements, there is something about that ruggedness.”

While Seattle has been a hub for life science organizations, the growth of the industry, and the city itself, has led to expansion on the Eastside. Life science companies that started off in Seattle didn’t have any more space to expand within the city.

“As Seattle has grown and companies have matured, you can’t put a manufacturing operations and things on that kind of scale in South Lake Union,” said Marc Cummings, vice president of public policy and external affairs at LSW. “So what we’ve seen over the past decade as companies have grown, they need space and over the last couple years you’ve seen this growth in the biotech cluster expanding into Bothell and the Eastside.”

More than economics

Redmond, Bellevue and Bothell lead the Eastside, taking second, third and fourth largest life science hubs, behind Seattle. Kirkland, Mercer Island, Kenmore, Issaquah, Sammamish, Carnation, North Bend and Snoqualmie all trail behind, but keep pace with most cities throughout Washington.

In 2017, the state’s industry represented $22.7 billion in total economic activity and contributed $11.5 billion in value-added activity to the state’s gross domestic product (GDP).

Life science has an economical impact for Seattle and the Eastside, but the overall benefits go beyond that. The industry as a whole strives to improve quality of life across the globe and minimize human suffering by eliminating diseases.

“As a doctor of public health, I am so happy to work for the industry helping millions of people around the world,” Alexandre said. “It’s an exciting industry to be a part of.”